Tax Advisor & CPA for Real Estate Pros

Strategic Tax Planning Year-Round

Our Services Are Well Suited For:

First Time Rental Property Investors

High-Income Professionals Exploring Real Estate Investments

Multi-Family Rental Property Owners

Short-Term Rental Property Owners

Real Estate Development Professionals

Self-Employed Individuals Investing in Real Estate for Tax Benefits

W-2 Employees Interested in Purchasing Rental Property

Business Owners Considering Real Estate Investment

Tax Advisory CPA for Real Estate Investors

Our tax advisory services are well suited for high income earners and business owners.

We work with individuals who are seeking to become, or are existing real estate investors.

Our goal is to provide strategic tax & accounting advice, while implementing your tax plan proactively throughout the year.

As a Certified Real Estate Tax Strategist, Kami Molin CPA provides tax advisory and accounting services to real estate investors seeking to maximize their tax advantages while building long-term wealth.

Strategic Tax Advisor for Rental Property Owners

We help high-income clients utilize the benefits of real estate as part of a complete tax plan. Our unique approach considers your complete financial picture, creating strategies that balance current tax savings with long-term wealth building.

An experienced tax advisor can be a valuable asset for high-income professionals in their transition to becoming rental property owners, incorporating real estate investment activity as part of a complete tax plan.

Whether you’re a business owner, W-2 employee or self-employed professional, strategic real estate investments can offer tax advantages for decades.

Kami Molin, CPA & Tax Advisor

Advanced Tax Strategies ForBusiness owners & High Income Earners

Specializing in California Real Estate Tax Advisory

Real estate investors in California are positioned to take advantage of tax opportunities that require specialized knowledge to navigate effectively. Properly structured real estate investments can create effective tax reduction strategies.

Whether you’re purchasing your first rental property or expanding your portfolio of short-term rentals, having the right tax advisor can make a significant difference in the tax implications of your investments.

Your Real Estate CPA

Providing Year-Round Tax Planning

How Tax Advisory Helps Real Estate Investors

Many real estate investors leave thousands of dollars on the table each year by working with tax professionals who lack specialized knowledge in real estate taxation.

We commonly see real estate tax mistakes such as:

- Missed deductions specific to rental property operations

- Improper entity structuring that fails to maximize tax benefits

- Missed depreciation strategies that skip potential tax savings

- Incomplete documentation of expenses and property improvements

- Failure to plan for tax events like property improvements, sales or 1031 exchanges

We work together with our clients proactively throughout the year to put personalized tax strategy into action.

Ready To Get Started? Contact Us

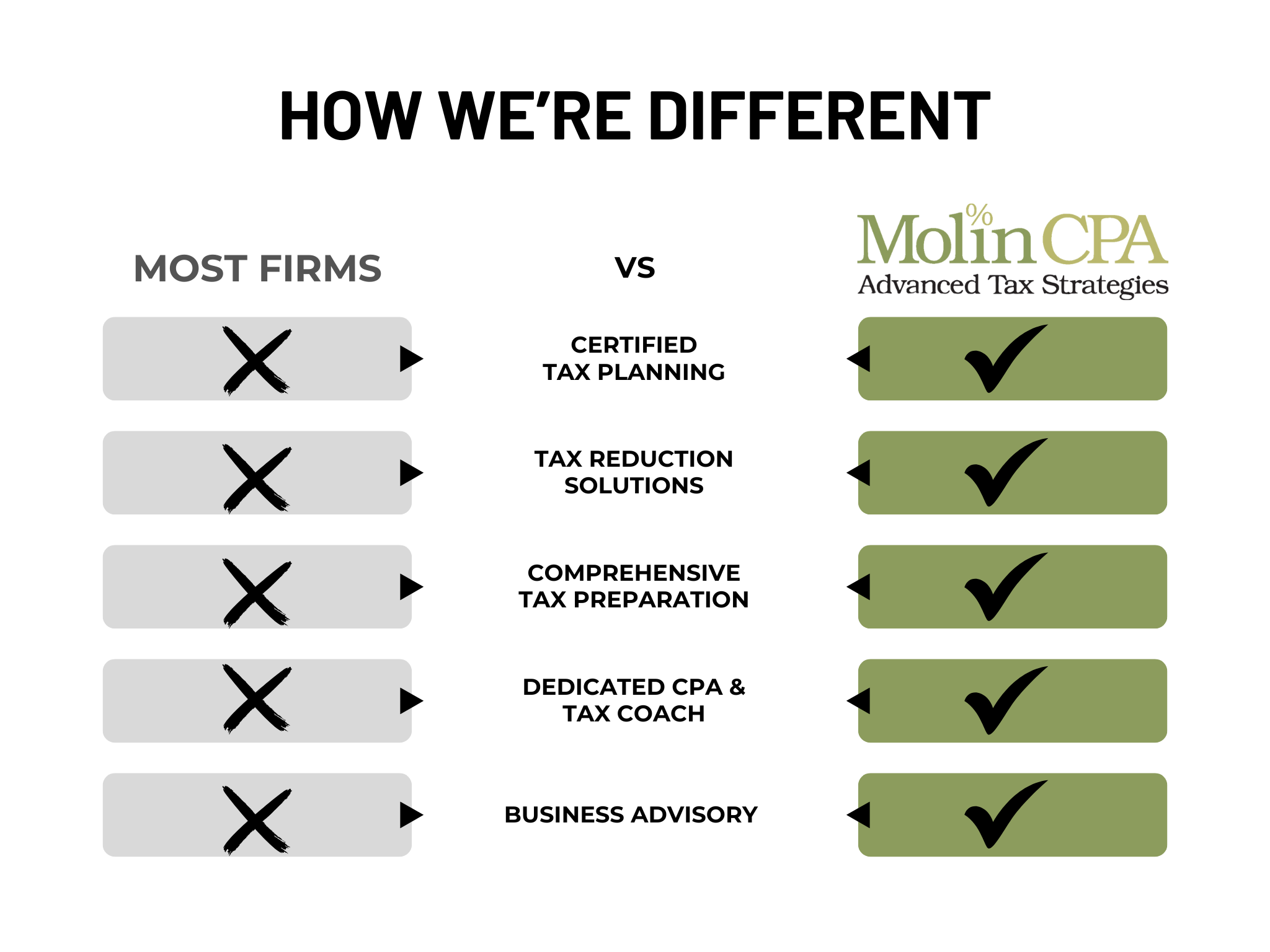

Our approach is different. We focus exclusively on tax & accounting strategies that work for real estate investors. With experienced tax advice, proactive planning and strategic implementation, our firm is able to deliver effective results beyond a traditional CPA firm.

Contact us today to schedule a consultation and discover how our specialized tax advisory services can help you achieve your real estate investment goals while minimizing your tax burden.

Tax Strategist for

Real Estate Investors

Helping Business Owners

Save Thousands In Unnecessary Taxes