Tax Advisor & CPA for Family Businesses

Strategic Tax Planning Year-Round

Multi-Generational Family Operations

Restaurant & Hospitality Groups

Product Design & Manufacturing

Vineyards, Farms, Agricultural Land Owners

Wholesale Distribution Companies

Beauty Suppliers & Equipment Retailers

Professional Service Practices

Building Supply Companies

Jewelry Retailers & Designers

Automotive Business Owners

Tax Advisory CPA for Multi-Generational Businesses

Our firm doesn’t operate transactionally—we build relationships with families that span generations.

Our approach to supporting multi-generational businesses combines technical tax & accounting expertise, practical implementation experience, and a deep understanding of the unique dynamics of family business operations.

Strategic Tax Advisor for Long Term Success

We understand that family business represents more than just economic value — it can represent your family’s skills, values, & reputation. More importantly, your business highlights your family’s impact on your local community.

Unlike transactional tax preparers and accountants who focus on annual compliance work, we invest in understanding your family’s values, goals, and dynamics. This relationship-centered approach allows us to provide advice that aligns with both tax objectives and business priorities.

Many of our client relationships span decades, providing us with the historical context and trust necessary to guide families through their most significant financial transitions.

Kami Molin, CPA & Tax Advisor

Advanced Tax Strategies ForBusiness owners & High Income Earners

The Dynamics of Multi-Generational Taxes & Accounting

Multi-generational businesses often develop complex structures over time, including operating multiple entities, real estate holdings, out of state entities, and family investment vehicles. As family businesses grow across generations, financial reporting & tax planning needs become increasingly important.

Our comprehensive tax advisory services ensure that you recieve a thorough approach that takes all factors into account, beyond simply making sure that all related entities meet their filing obligations. We’re dedicated to efficiently providing accounting & tax services while identifying ongoing planning opportunities. We’re strategic CPAs & Tax Advisors, ready to help.

CPA for Family Businesses

Providing Year-Round Tax Planning

How Tax Advisory Helps During Business Transitions

Business transitions often span several years, creating opportunities for income tax planning that complements transfer tax strategies. By carefully timing income recognition, capital expenditures, and retirement plan contributions, we can manage the tax impact during critical transition phases.

The transition of business ownership between generations can trigger significant tax events if not properly structured. Beyond income taxes, we know that estate taxes, gift taxes, and generation-skipping transfer taxes can substantially reduce the wealth passing to the next generation. Through proactive planning, these tax burdens can be minimized with advanced tax strategies.

Common Issues We See With Multi-Generational Business Tax Planning

It’s commonly referenced that in recent history, only about one-third of family businesses survive into the second generation, and just about twelve percent make it to the third generation.

The primary reasons for this business decline often relate to inadequate planning for business succession, tax implications, and family dynamics. When tax planning is reactive rather than proactive, significant portions of business value may potentially be lost during transitions.

Conversely, when families work with experienced Tax Advisors who understand both the technical and emotional aspects of business succession, they help position themselves for continued prosperity across generations.

Ready To Get Started? Contact Us

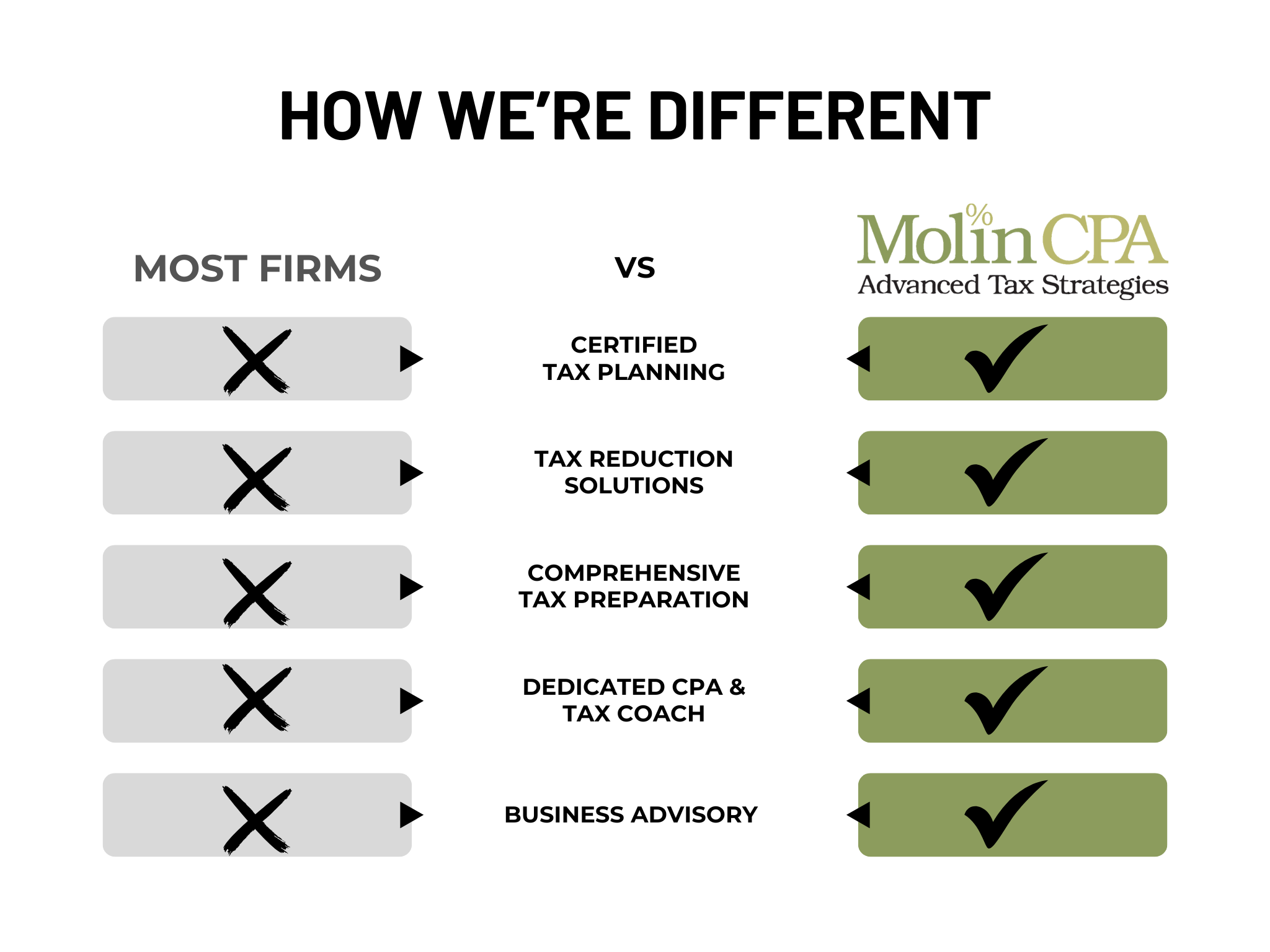

Our approach is different. We focus year-round on tax & accounting strategies that work for family businsses and multi-generational business owners. With experienced tax advice, proactive planning and strategic implementation, our firm is able to deliver effective results beyond a traditional CPA firm.

Contact us today to schedule a consultation and discover how our specialized tax advisory services can help you achieve your business goals while minimizing your tax burden.

Tax Strategist for

Multi-Generational Business

Helping Business Owners

Save Thousands In Unnecessary Taxes