Strategic Tax Advisor

Proactive Tax Planning CPA

What We Do

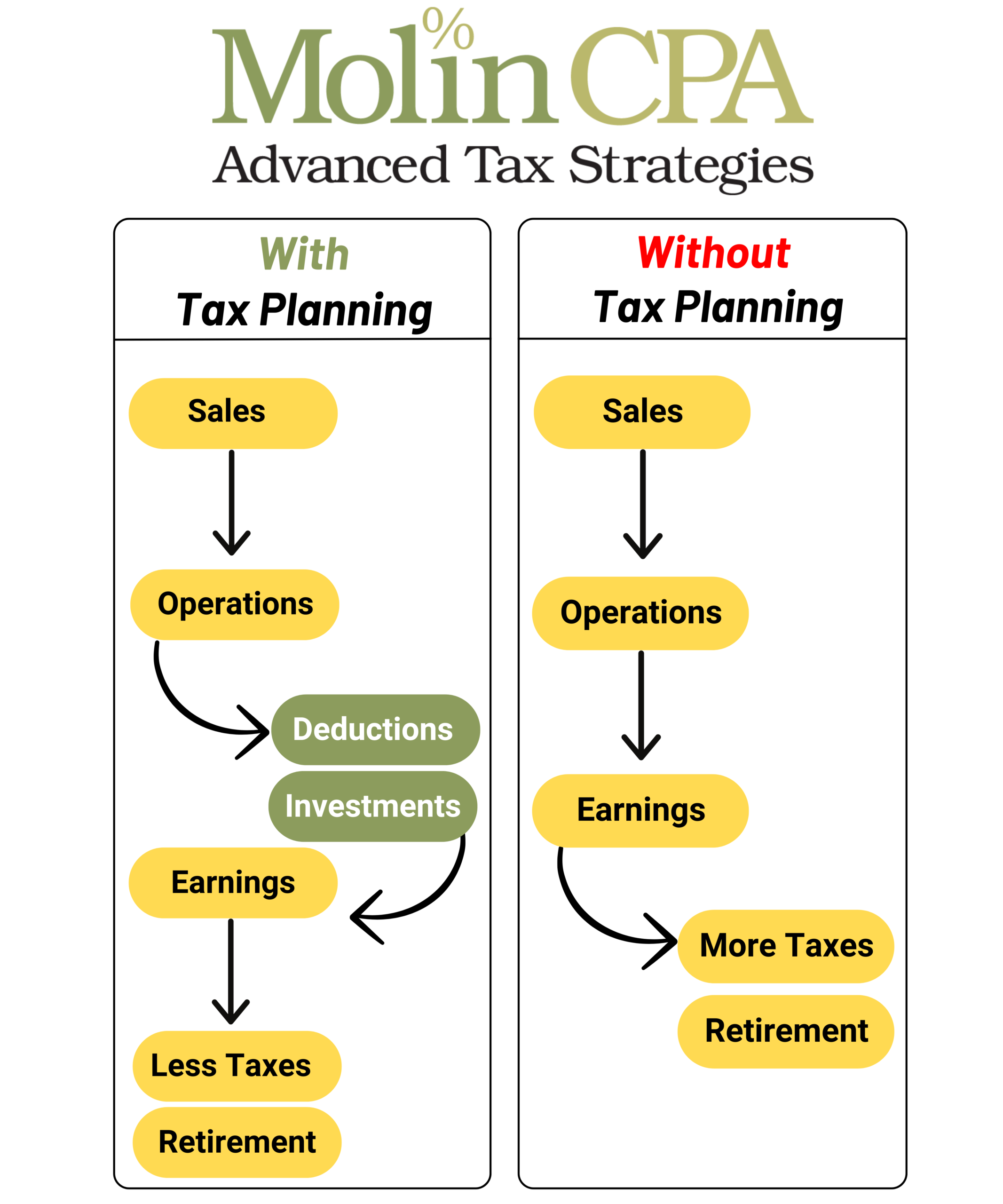

We are tax planning experts focused on identifying missed opportunities in your business and personal life.

Our tax advisory service has the ability to help you keep more of your hard earned income over time.

Working together, we diligently create personalized tax plans to significantly reduce tax liabilities and protect wealth for high income professionals.

Our Capabilities

- Federal & State Tax Credits

- Income & Expense Shifting

- Business Entity Structures

- Tax Code Loopholes

- Tax Investment Strategies

- Financial Accounting Strategies

- New Tax Opportunities

Our Process

Step 1: Collaborative Onboarding

Our comprehensive approach to tax planning is designed to take all of your financial goals and activities into account by first reviewing your key financial documents.

Step 2: Goal Oriented Planning

Working together on a goal-oriented business & personal tax plan, we prepare to implement a tax plan that serves your overall financial picture and business operations.

Step 3: Tax Plan Implementation

An effective tax plan requires implementation over time. Our team carefully puts your personal tax plan into action by developing tax advantaged solutions tailored to your financial activity.

Continued Tax Advisory

Once your tax plan is in place, benefit from our on-going tax & accounting advice combined with strategic business advisory when you need it.

Expert Tax Reduction CPA

Advanced Tax Strategies ForBusiness owners & High Income Earners

Tax Strategy FAQ

CPA vs Tax Advisor, What's The Difference?

Certified Public Accountants (CPAs) must pass the longest and most challenging accounting certification process. CPAs are tax experts with qualifications to do much more than prepare taxes.

Tax Advisors are professionals with expertise in tax law, tax planning, and tax compliance, dedicated to advising individuals and businesses on optimizing their tax situations.

Our firm combines these two areas of expertise, acting as an invaluable asset to any business owner seeking to control their tax liabilities.

How Does Tax Strategy Differ from Tax Planning?

Tax Planning is a more proactive approach to taxes. Tax planning can involve taking actions before the end of the year to minimize your assumed tax liability. This allows you to manage your cash needs more effectively while removing the uncertainty typically experienced when meeting with your tax preparer just once a year.

Tax Strategy is an advanced form of Tax Planning. Tax Strategy is a long-term advisory service that considers your current financial situation, tax & legal structure, future financial goals, and the tax law environment. Tax Strategy is typically best suited for high income earners seeking to preserve wealth over time.

How Do I Pick A Tax Advisor?

The tax code can be complex, and many tax professionals do not have the background to offer value to every business owner or individual financial picture. When deciding to work with a Tax Advisor on Tax Planning & Tax Strategy, we recommend working with a licensed & experienced CPA capable of understanding your financial life.

How We Can Help

Our strategic tax planning service is tailored to proactively manage your tax position year-round. Comprehensive tax planning can help you reach your financial goals faster. We are experts with specialized training in tax-optimized strategies and tax advisory.

Our Goal

When you sign on with Kami Molin CPA, we strive to build a longstanding relationship as your Personal Tax Advisor. Our goal is to assist in creating a plan to reduce tax exposure, so you can pay less at tax time and keep more of your income.

Comprehensive Tax advisory

Our approach to small business accounting offers more than just someone to oversee your bookkeeping and compile financial statements. When you sign on with us, you’ll gain a real partner.

Our advanced education as a Certified Tax Coach means that we have the skills to mitigate tax obligations, boost your personal income & increase business profitability.

A traditional tax preparer may not prioritize the time to find you real tax savings. Our firm is different because we’re highly educated in proactive tax planning techniques for business owners, entrepreneurs, and high net worth individuals.

We are more than accountants, we are highly-educated tax advisors. With our effective, legal, and ethical tax reduction strategies, our clients pay the lowest amount of tax required by state and federal standards.