Medical & Healthcare Tax Advisor & CPA

Strategic Tax Planning Year-Round

Medical Pros with Multiple Incomes

Primary Care Physicians

Independent Physician Assistants

Elderly Care Service Businesses

Dental Practice Owners

Surgical Specialists

Medical Facility Owners

Hospital & Healthcare Contractors

Independent Medical Practitioners

Tax Advisory CPA for Healthcare & Medical Industry

We provide comprehensive tax and financial advisory services to a diverse range of medical professionals. Whether you’re managing multiple income streams as a physician, overseeing a thriving veterinary practice, or building your independent dental practice, our expertise is tailored to your specific needs.

Strategic Tax Advisor for Independent Doctors & Medical Practice Owners

Our specialized services support primary care physicians, surgical specialists, and independent medical practitioners who need personalized tax strategies that reflect their unique income situations.

We also serve veterinary and dental practice owners, medical facility operators, urgent care business owners, and elderly care service providers who require integrated tax advisory.

Kami Molin, CPA & Tax Advisor

Advanced Tax Strategies ForBusiness owners & High Income Earners

We Understand Medical & Healthcare Accounting

Hospital and healthcare contractors, independent physician assistants, and medical professionals transitioning to self-employment all benefit from our deep understanding of the healthcare industry’s financial complexities. As a medical professional, your earnings potential may be constrained by taxes, making tax advisory a worthwhile service.

For W-2 earners with limited deduction opportunities, we focus on maximizing retirement contributions and identifying often-overlooked financial optimization strategies that can help keep more of your earnings in your pocket at tax filing season.

CPA for Medical Pros

Providing Year-Round Tax Planning

How Tax Advisory Helps Medical Pros

Our commonly discussed topics include:

- Tax reduction strategies

- Year-end income deferral

- Bonus timing planning

- Retirement plan maximization

- Backdoor Roth strategies

- HSA optimization

- Life insurance strategies

- Business insurance for new practice owners

- Legal entity selection

- Self-employment tax reduction

Our Primary Advice to 100% W-2 Earners in the Medical Field

As W-2 employees, medical professionals face increasingly limited options for reducing their adjusted gross income. At higher income brackets, these limitations become increasingly costly, since high-income earners pay the top marginal tax rates. W-2 employees cannot deduct business expenses, which is a significant disadvantage compared to self-employed medical pros.

Working with our firm on tax advisory, we can help address the tax limitations of W-2 employment, including overcoming the limited options for W-2 employees and advising on alternatives that can help reduce tax burdens for medical professionals.

Ready To Get Started? Contact Us

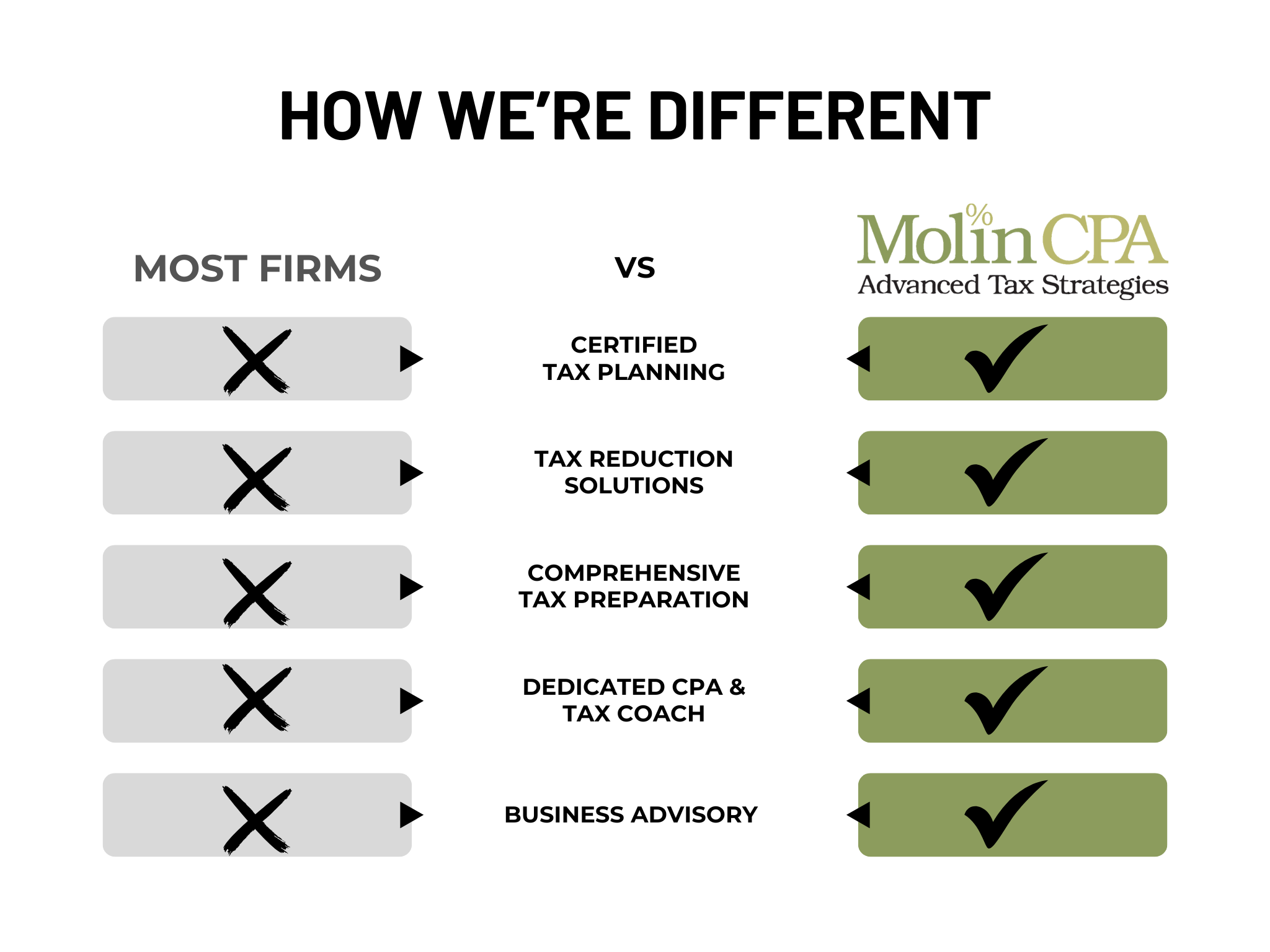

Our approach is different. We focus year-round on tax & accounting strategies that work for independent healthcare professionals & medical practice owners. With experienced tax advice, proactive planning and strategic implementation, our firm is able to deliver effective results beyond a traditional CPA firm.

Contact us today to schedule a consultation and discover how our specialized tax advisory services can help you achieve your business goals while minimizing your tax burden.

Tax Strategist for

Medical Pros

Helping Business Owners

Save Thousands In Unnecessary Taxes