Our Approach

Strategic Tax Planning Year-Round

We Are Your Dedicated Tax Advisor

When was the last time your CPA came to you with an idea on how to save you money on your taxes?

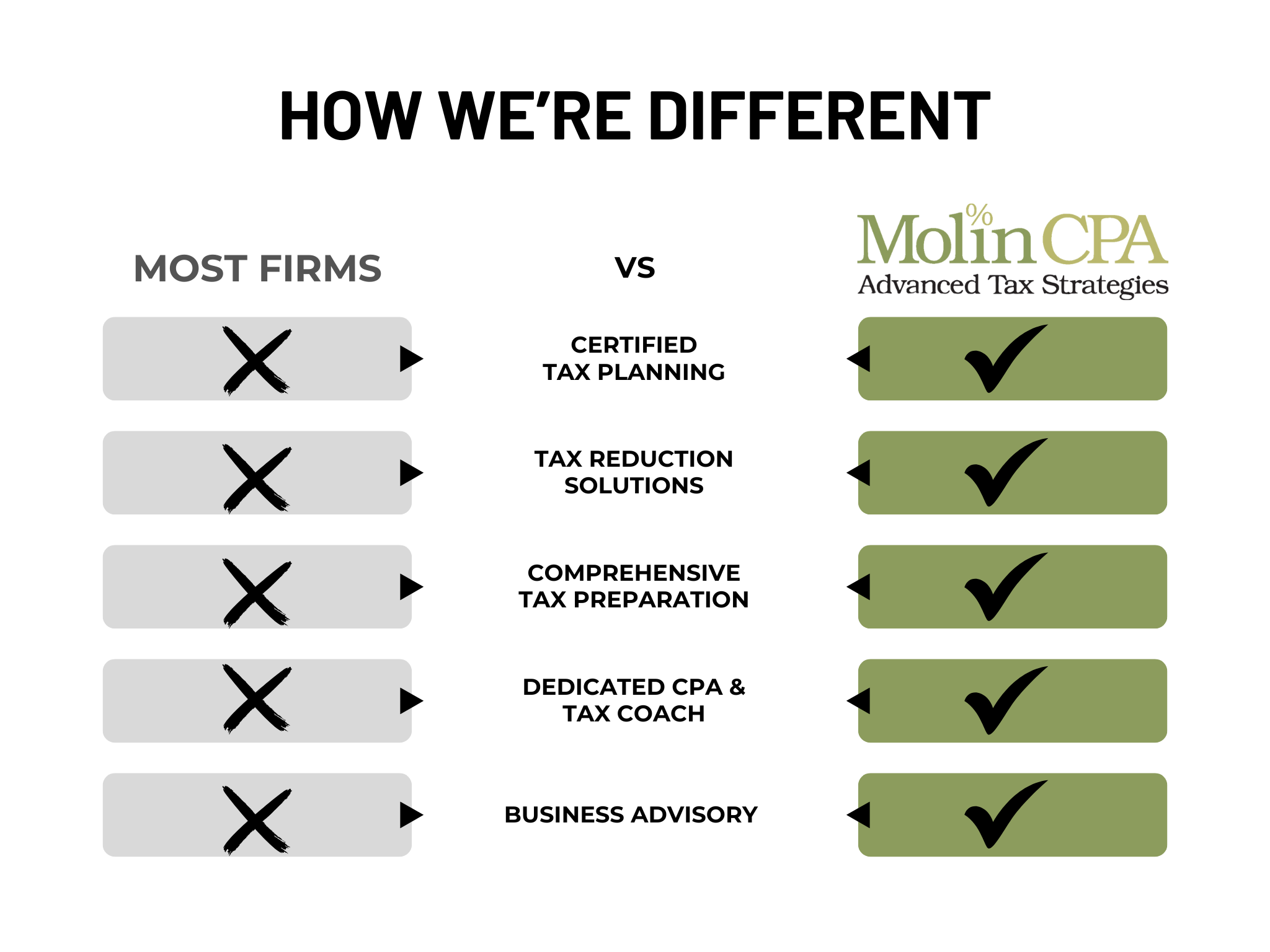

Not all CPAs and accountants are well versed in tax planning strategies.

Most tax preparers are only focused on compliance.

Many tax planners only want to create your tax plan, without providing the key steps of implementation.

Our firm takes the time to study your individual financial position.

We aim to be your dedicated CPA & Tax Advisor committed to business accounting solutions and tax optimization planning.

Throughout the year, we will work together to proactively put your personalized tax strategy into action.

Expert Tax Reduction CPA

Advanced Tax Strategies ForBusiness owners & High Income Earners

Proactive Tax Strategy CPA

Business Advisory & Tax Planning

How We Can Help

Our tax advisory firm helps clients develop forward-looking tax plans that maximize wealth preservation.

We provide Comprehensive Tax Analysis, Strategic Tax Planning, Business Structure Optimization, Retirement Planning Tax Strategies, Investment Tax Optimization, Wealth Preservation Techniques.

You can count on us for effective strategies that will lower your tax exposure and help you save more of your hard earned income.

Our Expertise

We’ve studied over 400 possible tax deductions in the U.S. tax code regulations.

Our expertise is identifying & applying tax reductions other preparers may miss.

You can rest assured your tax plan is based on well supported tax laws, keeping your business in the best tax position year-round.

Working together on results focused tax strategies, we deliver tax advice and implementation that serves your overall financial picture.

Tax Strategy CPA

Business Advisor

Helping Business Owners

Save Thousands In Unnecessary Taxes